Newsletters

Q&A With William Pesek

New Information about Upcoming Book Related News

Q&A With William Pesek

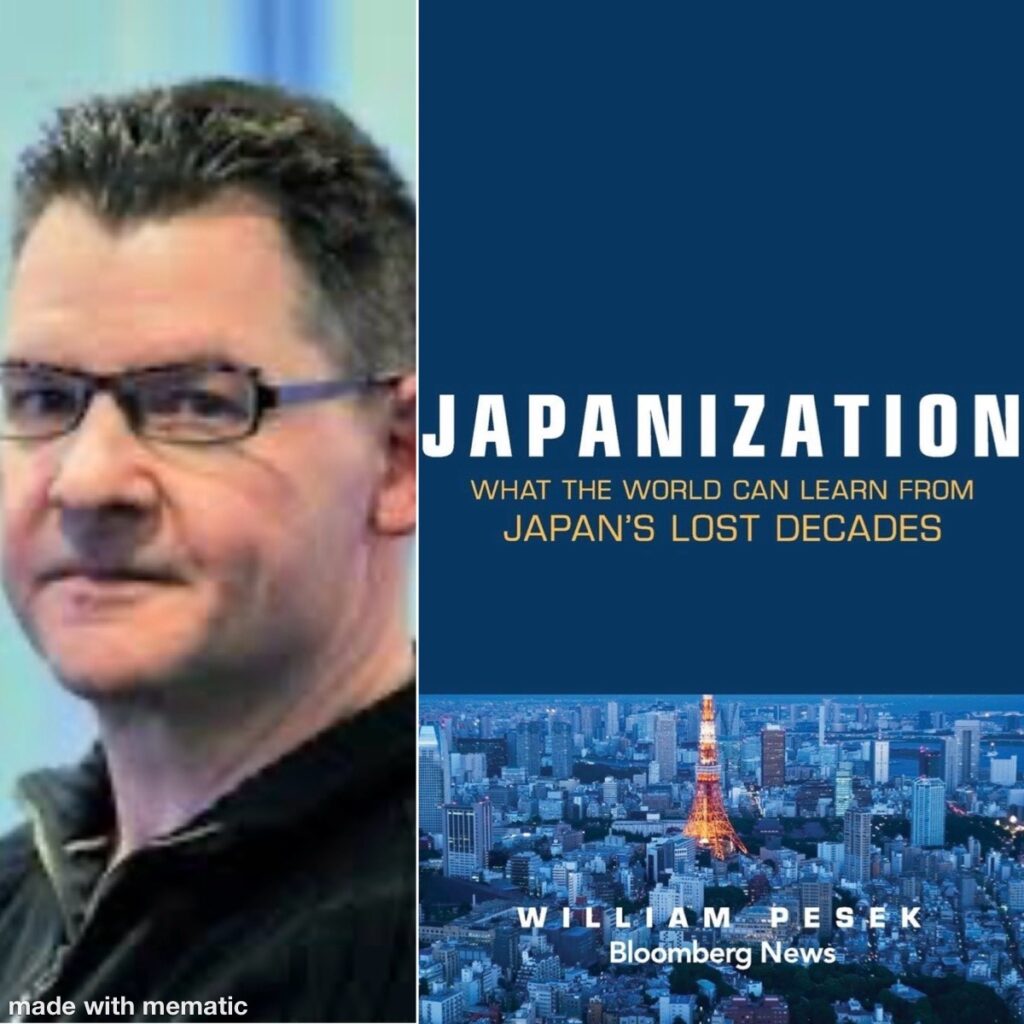

I am so glad to be doing this Q&A with author, journalist & columnist William Pesek! William is the author of the book Japanization: What the World Can Learn from Japan’s Lost Decades.

Q: William would you like to give a brief description of Japanization: What the World Can Learn from Japan’s Lost Decades?

A: Essentially, it’s an economic hole that policymakers can’t find a way to escape. It could be falling growth, deflation, a banking crisis, or a property crisis. The bottom line is that when an industry that’s vital to an economy collapse, takes the broader system down with it and then the political establishment has no idea how to respond. This explains Japan’s bad-loan stumble in the 1990s and it helps shed light on why China’s 2025 is so much in doubt as Asia’s biggest economy stumbles. My Japanization book looks at the root causes of such economic funks and, more importantly, how a nation can extricate itself from such a malaise. Sadly, Japan can’t teach a class for the rest of the world. It’s still trying to learn the lessons from its own misfortune even today.

Q: How long did it take you to write Japanization: What the World Can Learn from Japan’s Lost Decades?

A: Roughly 3-4 months. Not full-time. Lots of late night and weekend writing sessions. It came naturally because it flowed out of the issues I was writing about 24/7.

Q: From the title there’s a lot that people can learn from reading your book about Japan. What are the top lessons you hope readers learn after reading Japanization: What the World Can Learn from Japan’s Lost Decades?

A: To me it all boils down to chronic complacency. In Japan’s case, it was government and after government refusing to do the hard work, the heavy lifting, of addressing Japan’s 1990s bad-loan crisis. Rather than prod banks to dispose of toxic loans, politicians bailed out the bankers’ time and time again. In effect, Tokyo papered over big cracks in the financial system, rewarded behavior and incentivized bankers to keep making bad decisions. Tokyo politicians also abdicated their responsibilities to repair the economy and passed the baton to the Bank of Japan. Starting in 1999, the BOJ cut rates to zero to relieve stress on the system. By 2001, the BOJ pioneered quantitative easing. A quarter century of free money is still, today, modern history’s biggest experiment in semi-permanent corporate welfare. The BOJ has only managed to “normalize” rates to 0.25% so far. It’s a bad look that QE lives on, 23 years after the BOJ invented the discipline. It’s created quite a paradox: If the economy really is healthy, why not pull out the monetary intravenous tubes? If the BOJ thinks Japan still needs history’s biggest corporate welfare program, why should investors be bullish on the place?

The trouble is, other economies are failing to learn this lesson. Take China. This year’s downshift in Asia’s biggest economy is unleashing deflationary forces that Fitch Ratings warns “could become entrenched” if “current trends in the domestic economy are exacerbated.” Those current trends include a deepening property crisis of a magnitude that echoes Japan’s 1990s bad-loan crisis. The fallout from that debacle is still with Tokyo, as evidenced by stagnant wages and the BOJ still struggling to get short-term rates away from zero. The glacial pace with which China is fixing its property crisis makes the risk of Japanization worse and worse there.

Or take South Korea, which is making global headlines for all the wrong reasons. President Yoon Suk Yeol’s is the fifth Korean leader in the last 20 years or so promising to level playing fields, increase competition and hasten Korea’s ascent on global gross domestic product tables. In May 2022, Yoon’s conservative government won power on an economic renewal platform. He telegraphed a deregulatory Big Bang, steps to curb the dominance of family-run conglomerates, or chaebols, and curb Seoul’s fiscal excesses.

Yet Yoon, too, has been all talk, little action. Each new administration arrived in power, took a look at Korea’s chaebol-dominated model, saw the magnitude of the work needed to remake it, and pivoted to other pursuits. Like clockwork, each leader left the work of steering the trade-reliant economy to the Bank of Korea. Now, the fallout from Yoon’s desperate martial law degree on Dec. 3 will lead to even worse political polarization and legislative gridlock. None of this ensures Korea is headed for a Japan-like lost decade. But this pattern of complacency, coupled with recent events, raises the odds considerably. As 2025 approaches, I can make arguments for why India, Malaysia and Thailand all must pay very close attention to Japan’s lessons — or pay the consequences down the road.

Q: How do you juggle journalism, writing columns and being an author? What advice do you give anyone wanting to do one of them or all three?

The silver lining is that my day job often flows directly into writing a book like Japanization. But it’s always a challenge to juggle all these different roles, deadlines and competing projects. Especially in such a dynamic world where we literally don’t know where our roles, and the stories we must prioritize, will take us. Things can change so quickly. As a journalist, I’ve always been more fascinated by the what-does-this-event mean story or writing the where-that-issue-is going story more than breaking news. I mean we all love to be first. But in today’s cacophonous world, the ability to explain complex issues, to connect dots and to offer a view of where things are headed has equal, if not greater value, to getting to a story first. My advice is to enjoy the diversity of roles we play and the ways in which they, at least in my case, riff on each other. Also, to keep things interesting, make sure you tackle new topics/regions as often as possible. Never get too comfortable writing on a narrow range of issues. If I were only writing on Japan, for example, I might lose my mind a bit.

Q: Are you writing another book like Japanization: What the World Can Learn from Japan’s Lost Decades? Or will your next book be about a totally different topic?

A: My next target is gender in Asia. How countries that underutilize their female populations are resigning themselves to be less innovative, less productive and ultimately less successful in the long run. Japan, or course, is a major part of this cautionary tale. Korea, too. And China has its own challenges when it comes to leveling gender playing fields.

All available research shows that empowering women deepens the talent pool, makes economies more dynamic and competitive and helps offset an aging, shrinking population. As far back as 1999, Goldman Sachs estimated that Japan’s gross domestic product would be 15 per cent bigger if the female labor participation rate matched that of men. Yet 25 years later, current Prime Minister Shigeru Ishiba has barely even mentioned gender.

For decades now, Japanese governments claimed to be making “womenomics” a centerpiece of plans to reinvigorate the economy and end deflation. None more so than 2012-2020 Prime Minister Shinzo Abe, who promised to pull more women into the labor force and prod companies to promote women to executive positions and board seats. To make women “shine.” Sadly, it was more about photo ops than substance.

Earlier this year, the International Monetary Fund called out Tokyo once again for ignoring the gender gap. When Gita Gopinath, first IMF deputy managing director, listed priorities for structural reforms needed to “make the Japanese economy more dynamic,” the need for “measures to empower women in the labor market” topped the list. What has Japan’s patriarchy been doing all these years? Trying just about everything else imaginable to juice growth other than leveling gender playing fields. Officials slashed interest rates below zero, pushed debt to more than 260% of GDP, drove the yen down to three-decade lows and put out the welcome mat for foreign workers. Anything but make gender parity a priority. It’s an important topic. One I’m hoping to shine a brighter spotlight on.